Stop Falling for Stock Hype and Losing Money – Lessons from Relaxo

- Vipin Khandelwal

- Aug 13, 2025

- 5 min read

In the past month, I came across a few stock portfolios where one stock featured prominently - Relaxo Footwear. The stock showed a 50%+ loss and these investors held on.

What happened there?

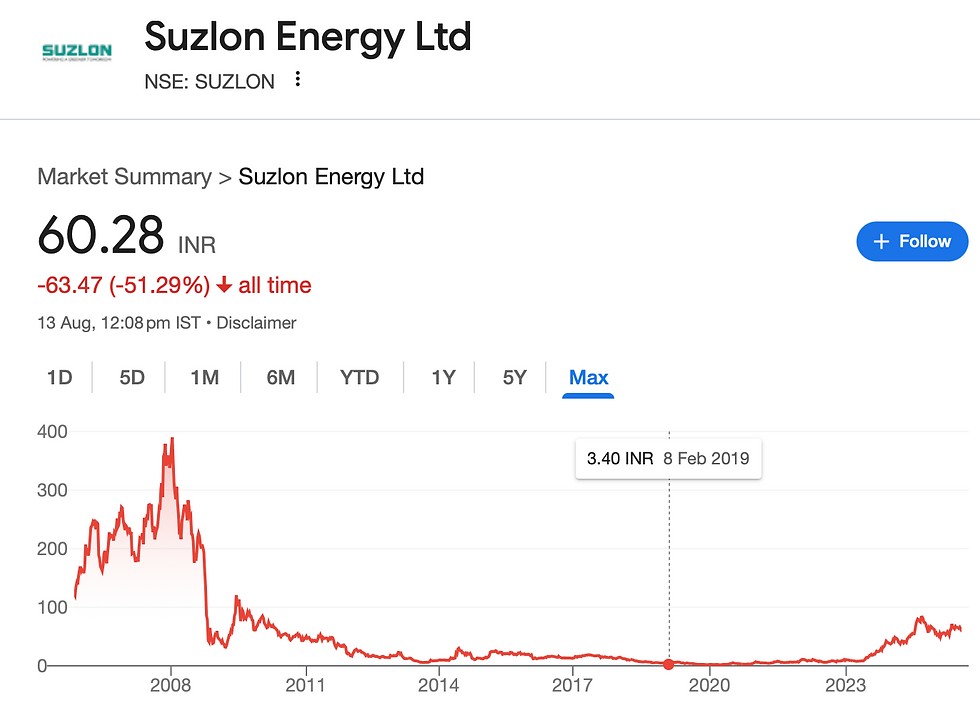

Many everyday investors get excited by "hot" stock stories during buzz times, spread by experts, big funds, and social media. They jump in without seeing the risks, chase rising prices, and end up with big losses. Think of Omkar and Kalyani (names changed), who bought into the "slipper magic" of Relaxo Footwears at its peak and kept adding more even as big investors sold out. Then there's Paytm, the "internet darling" that shocked many retail buyers hoping it would be the next big thing – listed at ₹2,150 in 2021, it crashed over 80% to lows around ₹439, and even after a recent rally to ₹1,126 (still down 47% from IPO as of August 13, 2025), many early investors remain underwater. These are just like the bigger traps in stocks such as Relaxo Footwears (down about 70% from its 2021 high of ₹1,448 to ₹435 as of August 13, 2025), Jet Airways (basically worthless now, trading rarely at around ₹34 during bankruptcy), Suzlon Energy (down about 86% from its 2008 high to ₹61, even after some comeback), and Yes Bank (down about 95% from its 2018 high to ₹18.72).

In each, early buzz from company leaders or popular funds pulled in crowds, but smart big investors got out in time, leaving regular folks who kept buying more as things worsened.

This note brings together these examples, with extra on Relaxo, to warn against repeats. It also explains how, instead of these costly errors, you can use reliable mutual funds (index or active) or a simple framework to grow money steadily.

The Same Old Mistake: Getting Tricked by Stock Excitement

India's stock market has many tales of "sure winners" that turn into big losers. People get drawn to stories of quick growth, comebacks, or hot trends, shared loudly on social media, in reports, and by well-known investors. They overlook signs like prices too high, strong rivals, big debts, or falling profits. They buy when things look great or just dip a bit, hoping to catch the rise. When trouble hits, they hold tight or buy more, sure it'll fix itself, but often face deeper losses.

Relaxo Footwears: The "Everyday Shoe" Story That Fell Flat

Relaxo is a classic case of how a basic product tale can sour. It grew from a small company, jumping from about ₹14 in 2010 to a top of ₹1,448 in October 2021, making early buyers 100 times their money. The buzz was about being India's top maker of low-cost shoes (10 lakh pairs a day) with no debt, known brands like Sparx, Flite, and Bahamas for budget shoppers (mostly simple open shoes at ₹100-500), and edges like making everything themselves and a wide sales network (over 650 partners and 1 lakh stores). Investor Saurabh Mukherjea from Marcellus boosted it in talks and videos, calling its "money-making slippers" a sign of steady growth from daily needs.

After COVID, in the year to March 2021, profits hit ₹291 crore with 20% margins, leading folks to liken it to solid firms like Asian Paints. Regular buyers, hooked by "buy what you use" chats on social media (like "Relaxo at bottom, head to 1200+"), piled in during 2022-2023 drops (around ₹900-1,000), seeing it as a safe play on village buying and nicer products. But issues arose: Higher material costs (tied to oil) cut margins from 55% to 50%, and price hikes lost customers (sales amounts fell about 8% in the year to March 2023).

New competitors like Zudio from Trent and Dmart grabbed share in a market where 60% is small, unnamed sellers, slowing sales to 4.7% growth in the year to March 2024 (₹2,914 crore total) and profits to ₹154 crore the prior year. The newest quarter (April-June 2025) showed sales down 12.6% to ₹655 crore from weak village demand, though profits up 10% to ₹49 crore from cost savings.

Marcellus cut back in late 2022 and left fully by January 2023, noting lost price control and market slice, but many regular folks (including Omkar and Kalyani) kept adding, hoping for better. At ₹435 now (priced high vs. slow growth), 2022 buyers are down 50-60% or more, making a "safe" pick a money drain.

The story continues with DHFL, Suzlon, Yes Bank, Jet Airways, Vodafone Idea, Future Retail.

Key issues: Stories over facts, buys on rises without value checks, emotional holds.

Outcome: Huge loss. ₹1 lakh at highs might be ₹5,000-30,000 now, vs. 12-15% growth in safe spots.

A Smarter Way: Use Reliable Mutual Funds or a Simple Framework

Skip these errors by choosing steady ways like good mutual funds (index or active) or an easy-to-follow framework. These focus on rules and facts, not buzz, for better long-term growth. Studies show rule-followers earn 10-15% yearly, vs. 2-5% for hype chasers swayed by feelings, specially with direct stocks.

Try the Magic Formula Framework

One simple, proven way is the Magic Formula by Joel Greenblatt, easy for anyone to use. It picks strong companies at fair prices by ranking on two things: high return on money used (shows good business) and high earnings vs. price (shows cheap buy).

Here's how:

Screen for big firms (over ₹20,000 crore market size) in tools like Screener.in.

Rank by return on capital (high means efficient profit-making).

Rank by earnings yield (earnings divided by price plus debt, high means undervalued).

Combine ranks, pick top 20-30.

Buy equal amounts, hold a year, then redo. This beats markets over time by finding quality at discounts, like avoiding Relaxo's high price or Suzlon's debt.

Greenblatt's backtests (in the US markets) show 30.8% annual returns from 1988 to 2004, more than double the S&P 500's 12.4%. More recent independent backtests from 2000-2022 report 17.2% average annual returns, outperforming the market by 9.3%. In other markets like Hong Kong from 2001-2014, it outperformed averages by 6-15%.

Or Go with Good Mutual Funds

If picking stocks feels hard, use mutual funds run by pros. Index ones (like UTI Nifty50) track markets cheaply (fees ~0.2%), spreading risk wide. Active ones (like Parag Parikh Flexi Cap for value picks or HDFC Flexicap for growth) offer a defined strategy run by professionals. Monthly sips to average prices help you dodge the hype timing. Past shows 12-18% yearly over 10+ years, safer than story traps.

Why These Work Better

Less Risk: Spot issues early, avoid 90%+ drops.

Steady: Rules or pros at least get your market returns and sometimes outdo markets significantly.

Growth: ₹1 lakh at 15% for 10 years hits ₹4 lakh, not zero.

Proof: Millions of investors have built wealth with this; Even frameworks like GreenBlatt shows that it wins over a long period of time.

Stop Losing Money

The pattern is clear and repetitive: exciting stories drive investment bubbles, retail investors enter near peaks, and systematic wealth destruction follows. Meanwhile, disciplined investors who focus on fundamentals and maintain systematic approaches build sustainable wealth over time.

The Choice is Yours:

Continue chasing stories and risk joining the long list of investors who lost 70-95% of their capital in "sure winners"

Adopt systematic approaches that have consistently created wealth over multiple market cycles

Immediate Action Steps:

Review current portfolio for story-driven holdings and concentration risks

Start systematic investing through SIPs in quality mutual funds

Educate yourself on fundamental analysis and valuation techniques

Create written investment rules and stick to them regardless of market emotions

Remember: Building wealth is a marathon, not a sprint. The market rewards patience, discipline, and systematic thinking far more than it rewards excitement and speculation. Your financial future depends on learning from others' mistakes rather than repeating them.

If it sounds too exciting to be true, it probably is. If it seems too boring to work, it probably does.

---

Note: This post is for educational purposes only and should not be considered as investment advice. Past performance does not guarantee future results. Please consult with qualified investment advisors before making investment decisions. Or, talk to us.

Comments